SmartDraw collects VAT in the following countries:

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Ireland

- Italy

- Latvia

- Lithuania

- Luxembourg

- Malta

- Netherlands

- New Zealand

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

- United Kingdom

We are only able to waive VAT if you are able to provide a VAT ID number.

For more information about the Council Directive introduced in 2003 describing the requirement for non-EU suppliers to abide by the same VAT laws as EU suppliers with regards to selling software please visit:

http://ec.europa.eu/taxation_customs/taxation/vat/how_vat_works/telecom/index_en.htm

http://eur-lex.europa.eu/legal-content/EN/TXT/?uri=uriserv:l31044

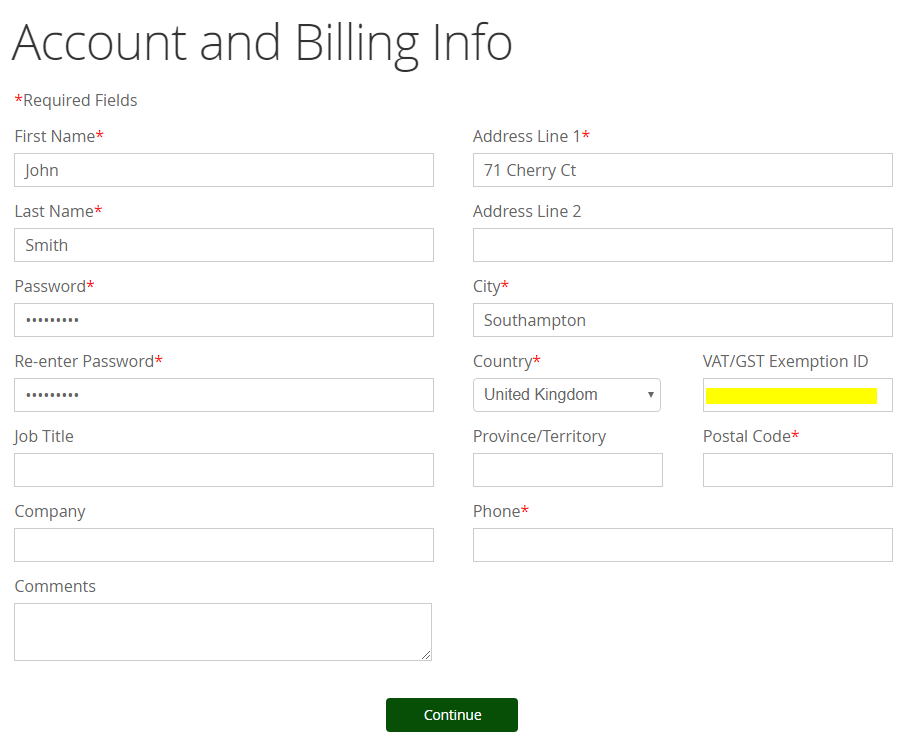

When placing an order, you may enter your VAT-ID in the Account and Billing Info section:

If you would like a quote excluding VAT, please submit a request and provide your contact information, VAT-ID, and products you wish to order.

If you have already ordered and are tax exempt, you may request a VAT refund by submitting a request. You will need to provide your order information or license-id as well as your VAT-ID.